It may not have been the dramatic bounce-back housebuilders had hoped for, but the final quarter of last year did provide at least a little hope.

Following a third quarter in which share prices continued to plummet across the sector, the three months to the end of December saw the pain ease.

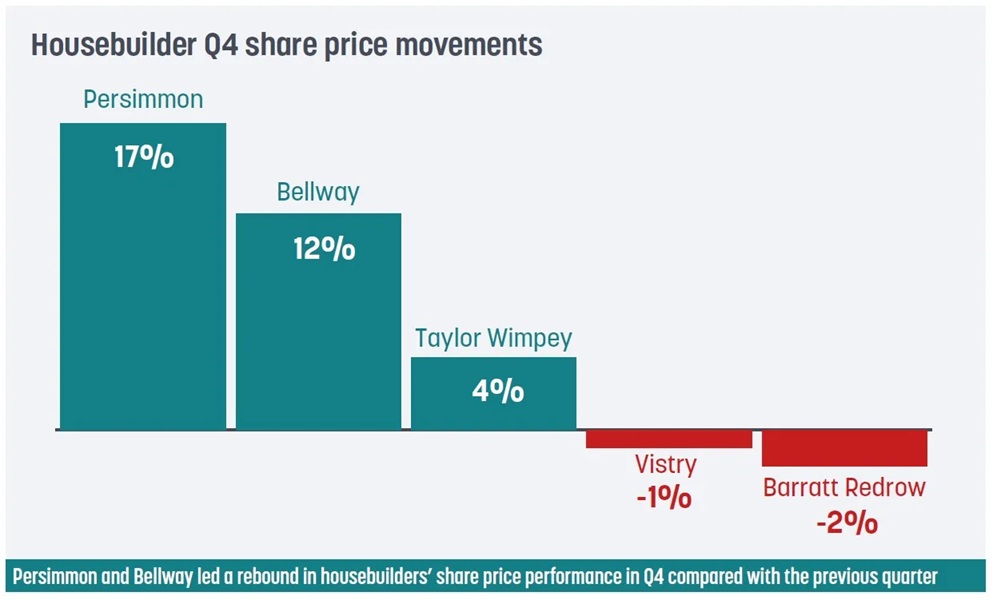

Investors in Persimmon, in particular, will be breathing a sigh of relief as the group’s share price improved 17.2% on a quarterly basis to £13.59 during Q4.

Bellway, too, impressed during the quarter as its shares leapt 11.8% to nudge above £27 each, but the group still suffered an 8% fall for the full year. Taylor Wimpey, which increased its share price 3.8% during Q4 to 107.5p, also began to put a smile on shareholders’ faces, despite a near-18% fall over the whole year.

Despite a 2.3% fall for Barratt Redrow as it continues to search for the benefits of its October 2024 mega-merger, the company’s shareholders will also be relieved to see an improvement on Q3’s 12% share price slump.

As for Vistry, it managed a full year without announcing yet another profit warning, and with a mere 0.8% fall in its share price in Q4, investors may finally be looking forward to some gains in 2026.

Early trading in 2026 suggests the momentum seen in the final quarter of last year has broadly continued, with most of the major housebuilders’ shares either edging higher or holding on to their Q4 gains.

Shane Carberry, an analyst at Goodbody, says that while nervousness leading up to chancellor Rachel Reeves’ Budget at the end of November caused the housing market to stall, the actual measures she announced did not live up to the fearful expectations of many, which helped the sector’s recovery.

“In terms of Q4, it was a little bit messy, given the timing of the Budget, and it felt like a lot of consumers were probably sitting on their hands, waiting to pull the trigger on any transactions of size, because they wanted to see what would come out of it,” says Carberry.

Housebuilders essentially had a bit of a rally in the last quarter

Aynsley Lammin, Investec

“The Budget was all pretty bland from a UK housebuilding perspective,” he adds. “There was nothing good in there, per se, but nor was anything really expected in terms of stimulus or anything of the sort. In fairness, the negatives weren’t too bad either. I think it was a fairly neutral outcome in the end.”

Carberry’s summary echoes many observers’ view that pre-Budget rumours had affected housebuilders’ sales rates.

“It was no surprise that the updates from the likes of Persimmon, Vistry and Taylor Wimpey at the beginning of January were downbeat in terms of how 2025 actually finished,” he adds. “All of them made similar points in terms of it being a tough end to the year.”

Aynsley Lammin, equity analyst at Investec, shares Carberry’s view. “Housebuilders essentially had a bit of a rally in the last quarter,” he says. “The expectation was the Budget would have a dampening effect and hit confidence, and everybody was worried about things like crazy property taxes. As a result, the market basically froze in the autumn.

“As we got nearer to the Budget, the expectation that it wasn’t going to be a complete disaster in terms of property taxes and fiscal-side problems [meant that] their share prices did rally from the lows in the summer, but they’re still weak in terms of where they’ve been [previously].”

Housebuilding’s top performers

The housebuilders that performed particularly well both throughout 2025 and in Q4 are Bellway and Persimmon, Lammin notes.

Bellway chief financial officer Shane Doherty, who joined the board in 2024, has been driving share buybacks with good momentum and is working to execute the group’s long-term growth plans.

Last month, Persimmon reported that completions rose 12% year on year in 2025, with underlying pre-tax profits standing at the upper end of market expectations.

Meanwhile, fears of further profit warnings at Vistry have not materialised. The group revealed three profit warnings from October to December 2024 after uncovering cost overruns on nine sites in southern England, which sent its shares plummeting at the time. Lammin says: “Although [Vistry’s] share price has still been pretty poor, there was just relief that there weren’t further profit warnings.”

In the 12 months ahead, analysts anticipate a more optimistic landscape than last year. Carberry says: “I think softer demand metrics – things like website visits and engagements – seem to have been a little bit more positive, but we certainly need a little bit more evidence of realisable demand through the first quarter of the year before we can set our expectations on just how optimistic we can be for 2026.”

Lammin agrees: “There is hope that the spring selling season will be the key catalyst in the near term. Housebuilders’ share prices could have a good period if we get some positive news around the spring selling season in terms of sales rates and maybe even general trading.”

However, there is the threat that political events could continue to hit trading – such as this year’s Budget and May local elections.

Lammin says: “If we assume that the spring selling season is actually OK, the sustained recovery into the second half is probably going to be more dependent on political and Budget issues again, rather than macroeconomic issues.”

While housebuilders hogged the headlines for their Q4 share performance, across the wider listed real estate sector, two other REITs stood out, says Oli Creasey, head of property research at Quilter Cheviot. “British Land and Hammerson finished strongly at the end of last year,” he notes. British Land’s shares rose by almost 15% to 403.8p in Q4, and Hammerson’s investors enjoyed a 12.5% climb to 330p.

Turnaround for Hammerson

Creasey adds: “Hammerson is an interesting one because the past few years have been very tough for the company, but it seems to have finally turned things around; 2025 was a good year for it in general, and the fourth quarter carried that on.”

According to Creasey, there may be a narrative about a shopping centre revival, but he adds: “I think my institutional bias against an asset class that has halved in value over the past 10 years is maybe holding me back from getting more enthusiastic about it – but I am forcing myself to test that at this point.”

Meanwhile, British Land had a tough first half of the year, but in November it upgraded its guidance for 2025 and the following year as well, which was well received by investors. “So, it had a bit of a bumper fourth quarter,” Creasey says.

There is one thing it seems every observer agrees on, whether in the housebuilding market, for REITs or for the entire listed real estate sector: there is only so much that individual companies can do in terms of performance, as long as politicians continue

to deliver little other than uncertainty.

Follow us on Twitter

Follow us on Twitter

Follow us on LinkedIn

Follow us on LinkedIn