Political uncertainty and regulatory headwinds are undermining the UK’s appeal as a real estate destination in the eyes of global institutional investors, Property Week can reveal.

Investec Real Estate’s latest biannual Future Living survey, which covers global investors active in the UK living sector representing more than £300bn of assets under management (AUM), reveals that over three quarters (76%) of respondents believe political uncertainty in the UK has undermined market confidence.

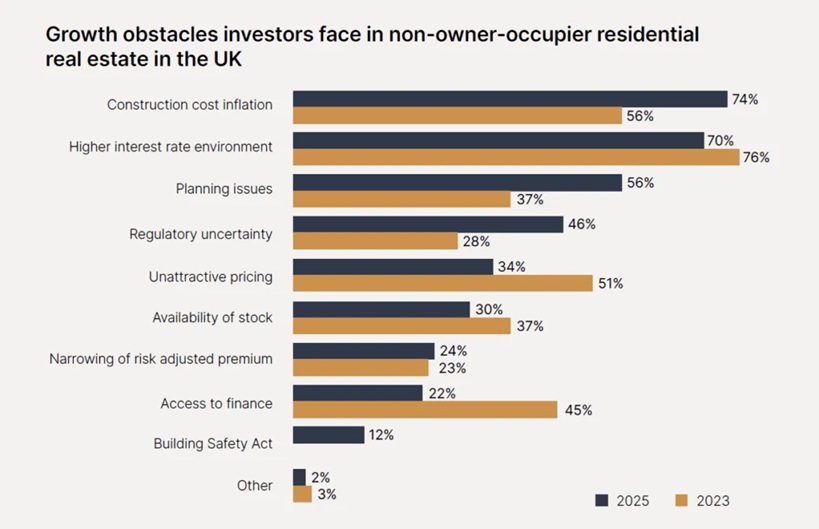

Source: Investec’s Future Living report

The report highlights a challenging market backdrop facing investors in the sector, with around 60% of respondents warning that the UK risks losing ground internationally unless interest rate cuts come at a faster rate.

Regulatory headaches have also hit confidence, with nearly half (46%) of investors citing regulatory uncertainty as an obstacle to investing in non-owner-occupier residential real estate, nearly double the 28% in the previous report in 2023.

Starkly, Investec report’s shows that 92% of investors think the Building Safety Act (BSA) has negatively affected their real estate strategies and operations.

Of those, 68% report higher compliance costs, 60% point to increased administrative burdens and 54% highlight extended project timelines.

As a result, three quarters of investors have recently adjusted their real estate strategies. Almost half of these (46%) have shifted their focus away from development, pivoting towards refurbishing or repositioning existing assets.

More positively, 88% do not consider the BSA a major obstacle to the growth of UK non-owner-occupier residential real estate in the long term, according to the report.

Jonathan Long, head of corporate real estate lending at Investec, said the report “clearly identifies the challenging market backdrop and regulatory headaches currently facing investors in the UK living sector”. He added that pre-Budget uncertainty was compounding this challenging fiscal backdrop.

Long did, however, point out Investec’s outlook that these headwinds were primarily short term, with “compelling long-term demographic demand”.

The report reveals that 84% of investors expect to increase or maintain their allocation to the living sector over the next five years.

This comes amid an improving financial backdrop, with only 22% viewing it as an obstacle, down from 45% in 2023.

Planning is now viewed as an obstacle to growth by 56% of respondents, up from 37%, while construction cost inflation (74%) and the higher-for-longer interest rate environment (70%) are cited as the top barriers to growth.

The recently enacted Renters’ Rights Act saw a split, with 50% saying it would lead them to increase exposure in the later-living sector, with a similar number saying it would prompt them to decrease investment in single-family rental.

Follow us on Twitter

Follow us on Twitter

Follow us on LinkedIn

Follow us on LinkedIn