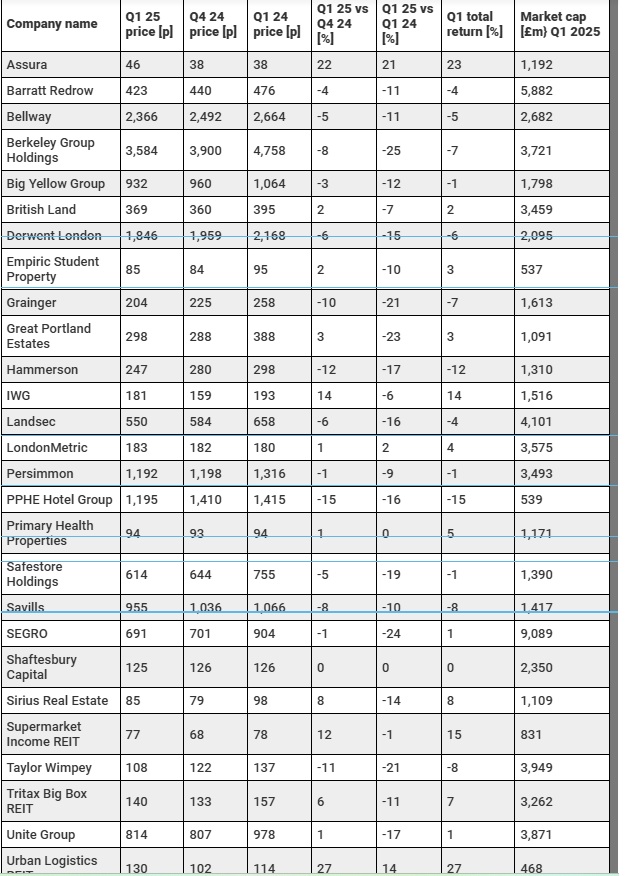

The share prices of the 29 FTSE 100- and FTSE 250-listed property firms monitored quarterly by Property Week remained flat in Q1 2025, but were down 12% on average year on year.

Healthy competition: the share price of Assura, which owns NHS-leased properties, rose 22% in Q1 after it received two takeover offers

During the quarter, analysts came to a consensus that while real estate was still on the road to recovery, with growth predicted for the year ahead, it would be at a slower pace.

Q1 kicked off with bond market volatility that pushed the 10-year gilt yield up to 4.93%, a level not seen since the 2008 financial crisis, while the 30-year gilt yield soared to 5.37%. This came amid high interest rates and the Bank of England’s reversal of quantitative easing. Meanwhile, the major stock market impact from US president Donald Trump’s tariffs came just after the end of the quarter.

Amid this market uncertainty and bond market volatility, merger and acquisitions activity became a defining feature of Q1. This trend, continuing consolidation in 2024, was driven by rising inflation and interest rates taking a particularly heavy toll on listed REITs. Increased vacancy rates also led to falls in share prices and most listed REITs trading at significant discounts to net asset value (NAV), driving them to seek access to the scale of capital they require to boost their performance.

Share price movements for our sample of 29 leading property FTSE 100/250 companies

Infogram

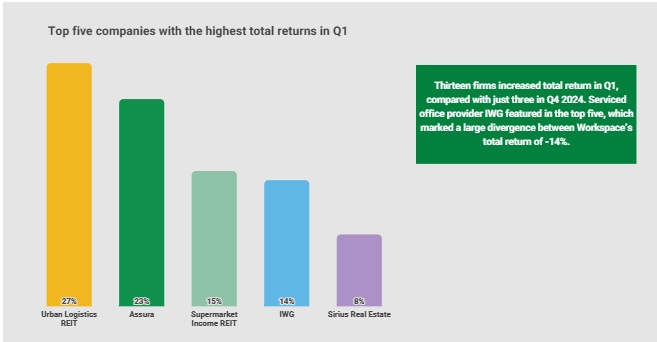

The top two performers in Q1 were the target of takeovers during the quarter. Assura’s share price rose 21% quarter on quarter and 22% year on year; and Urban Logistics REIT gained 27% quarter on quarter and 14% year on year. Additionally, the share price of Tritax Big Box REIT, which merged with UKCM last year, gained 6% over the quarter.

Oli Creasey, head of property research at Quilter Cheviot, says: “Urban Logistics wasn’t an active takeover target [sector at the start of Q1], but there was speculation. So, I think it’s safe to say there was a bit of smoke before the fire, and the market picked up on it.”

Since the end of Q1, LondonMetric has made an offer to acquire Urban Logistics REIT, valuing the company at 145p per share (pps), or £674m, and had until 9 May to formalise the offer, as Property Week went to press.

Takeover bids

Assura, meanwhile, received offers from Primary Health Properties (PHP) and a consortium of Kohlberg Kravis Roberts & Co (KKR) and Stonepeak Partners during Q1. On 9 April, Assura agreed for all its shares to be acquired by Sana Bidco, a new company owned by funds advised by KKR and Stonepeak Partners. Assura’s directors recommended unanimously that shareholders voted in favour of the offer, which valued the firm at £1.6bn.

The deal is not done yet, with PHP “considering its options” following Assura’s rejection of its bid. PHP’s board said it would continue to engage with Assura to explore a possible combination, which analysts believe holds appeal, despite the lower price per share: PHP’s offer valued Assura at 46.2pps, or £1.5bn.

Top five companies with the highest total returns in Q1

Infogram

Creasey says: “At one point their offer wasn’t competitive, but PHP’s share price has rallied, so they’re back in the running. It’s now neck and neck with KKR’s bid, which is cash and doesn’t move with the market. So, PHP could come back with a formal offer that’s suddenly viable. It’s game on.”

In Q1, PHP’s shares nudged up 1% quarter on quarter. PHP’s cash offer for Assura would be fully financed through new third-party debt, making it unlikely to have the funds to invest in healthcare infrastructure in the short term.

The deal would also take PHP’s loan-to-value ratio above its 40% to 50% target range. Creasey says while PHP would need to gear up significantly to execute the deal, “for a once-in-a-generation opportunity, you might accept it”.

He adds: “I doubt they [KKR] realise how slow development is in this sector. It’s glacial. PHP has that advantage – they’re known for being patient and well connected in the NHS ecosystem. They know when to push and when to hold back. KKR might struggle to replicate that overnight.”

PHP could come back with a formal offer [for Assura] that is suddenly viable. It’s game on

Oli Creasey, Quilter Cheviot

Another key Q1 trend was an average 5% fall in share prices for the six housebuilders in the sample. Aynsley Lammin, equity analyst at Investec, says: “Expectations were cut [in Q1], and consensus numbers came back to reflect a slower recovery in profit this year.

That said, the spring selling season and trading news were OK. We’ve seen a bounce in activity and sales rates have improved.

“There’s still no house price inflation, so the environment remains challenging, but trading has picked up.”

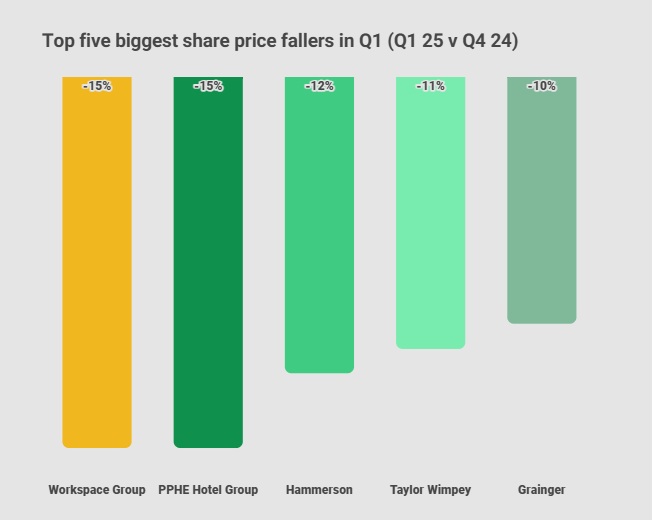

Taylor Wimpey saw the largest fall in share price from Q4 2024, down 11%, followed by Berkeley (down 8%), Bellway (5%) and Barratt Redrow (4%). The other two housebuilders in the sample, Vistry and Persimmon, both experienced a 1% fall in share price.

During the quarter, Taylor Wimpey warned investors that it expected building costs to rise as a result of the wider economic backdrop, while its full-year results for 2024 revealed a 32% drop in profit before tax.

Since the quarter ended, the housebuilder has reaffirmed it is on track to meet its full-year profit target of around £444m. Its shares were down 3% in the year to the end of April, compared with an average sector-wide rise of 3%.

Top five biggest share price fallers in Q1 (Q1 25 v Q4 24)

Infogram

Taylor Wimpey’s shares are trading at 92% of the projected tangible NAV for the calendar year 2026, meaning the market values the company at less than its forecast net assets, which could imply undervaluation.

Vistry’s shares were down 54% year on year in Q1 after it issued three profit warnings last year, the last one on Christmas Eve; but it ended the quarter relatively unscathed, with a 1% quarter-on-quarter share price fall.

Lammin says: “Coming into this year, the stock had stabilised. They’ve since tried to reassure the market about their medium-term targets and remain committed to their partnerships model. The lack of further profit warnings helped the share price stabilise.”

Reversal of fortune

Elsewhere in Property Week’s sample, PPHE Hotel Group’s share price fell 15% over the quarter and 16% year on year – a stark contrast to the previous quarter, when the firm stood out by bucking the trend of property share price falls. One reason for this reversal of fortune could be that Q1 is traditionally its quietest quarter of the year.

It could also be a reaction to non-executive chair Eli Papouchado stepping down from his role amid an HR-related claim against him by an employee of a company outside the group. Papouchado, a founder of the group and chairman since 1989, denies the claim and is contesting it.

Meanwhile, the divergence between the share performance of British Land and Landsec grew in Q1, with the former up 2% and the latter down 6%. In February, Landsec revealed a major pivot towards the residential

Follow us on Twitter

Follow us on Twitter

Follow us on LinkedIn

Follow us on LinkedIn