It was a tough third quarter for UK-listed property stocks as a combination of macroeconomic factors hit sectors across real estate. However, while commercial stocks suffered, it was housebuilders that stood out among the poorest performers, with concerns over the residential market continuing to drag on the sector.

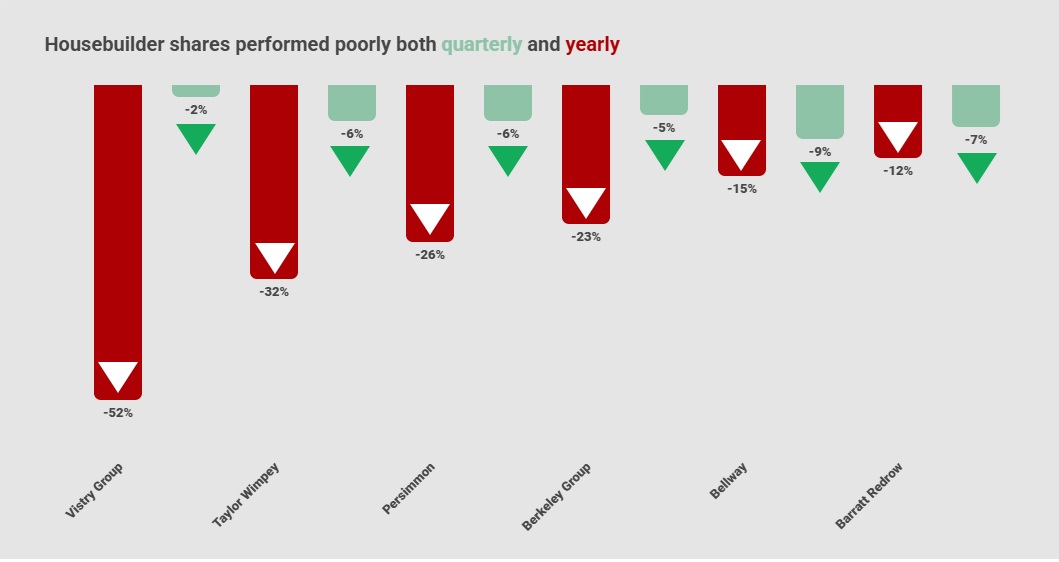

Housebuilder shares performed poorly both quarterly and yearly

Infogram

During the three months to the end of September, the worst performer of all property stocks was Bellway, whose shares slumped 9% during the quarter. Shareholders in the recently merged sector giant Barratt Redrow saw their investments fall 7% in value, while Persimmon and Taylor Wimpey also suffered, both down 6%.

According to Alastair Stewart, a property and construction analyst at Progressive Equity Research, a lack of confidence in the housing market is largely to blame for the value falls across the sector. “Housebuilders have always been susceptible to the public mood music,” he says. “Most of the housebuilders’ shares trended down in Q3.”

Housebuilders were among the biggest fallers across all UK real estate stocks over the quarter, while year on year the situation for the sector was even worse. Shares in Taylor Wimpey have fallen 32% over the past 12 months, followed by Persimmon (-26%), Berkeley Group (-23%), Bellway (-15%) and Barratt Redrow (-12%).

Housebuilders have always been susceptible to the public mood music

Alastair Stewart, Progressive Equity Research

In the first quarter of the year, concerns around the impact of last year’s Budget eased, which led to a bounce in visitors and sales leads among the housebuilders.

Now, however, anxiety over chancellor Rachel Reeves’ second fiscal event has revived “project fear”, as Stewart puts it. He adds: “After the spring bounce this year, it just seemed that someone had turned off the lights after Easter. Project fear 2.0 lasted even longer this time, and we’ve had more than a month to worry about tax rises that might not materialise.”

Waiting for decisions

Possibly reflecting this, the sector’s shares have risen by 6% in the past month. So it is worth observing that the sector is, on average, trading at a 5% discount to the latest net tangible assets; in the past decade, it has averaged a 43% premium and company balance sheets remain strong, according to Stewart. “Most chief executives will be longing for Reeves to just get on with it,” he says.

Meanwhile, residential developers in sectors such as build to rent have had a rougher ride, but Stewart highlights “increasing signs” that UK and international investors are poised to invest billions in UK rental assets, also including student and affordable housing.

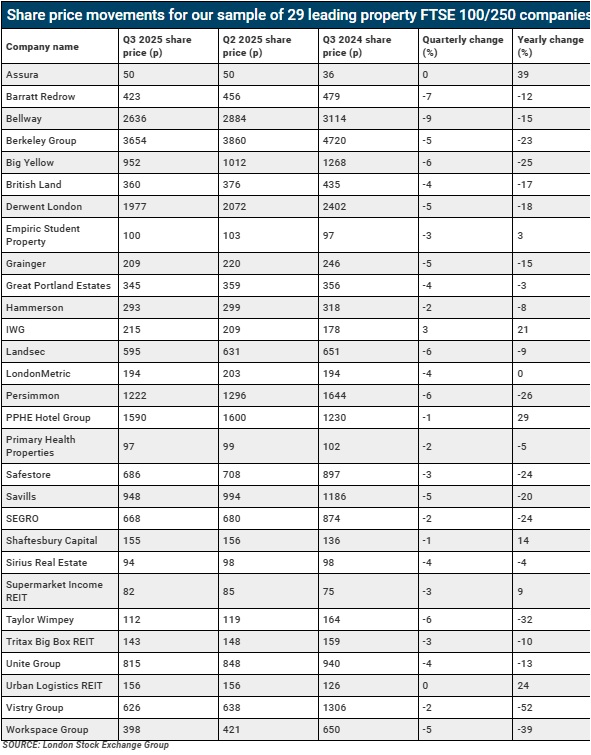

Share price movements for our sample of 29 leading property FTSE 100/250 companies

Infogram

Aynsley Lammin, equity analyst at Investec, believes housebuilders have “suffered from a continuing short-term squeeze with hopes of a second-half recovery fading”. He explains: “The share prices weakened on interest cut expectations being pushed out to 2026, the planning and regulatory cost backdrop remaining difficult, with site openings for 2026 proving more difficult than hoped, and margins being squeezed by subdued house prices but with continuing build-cost inflation.”

On the wider front, uncertainties ahead of the Autumn Budget, particularly around potential residential property taxes and bond market impacts on mortgage rates, have all weighed on sector share prices, according to Lammin. “In a nutshell, hopes of recovery gathering momentum in the second half of 2025 faded from late spring and early summer,” he says.

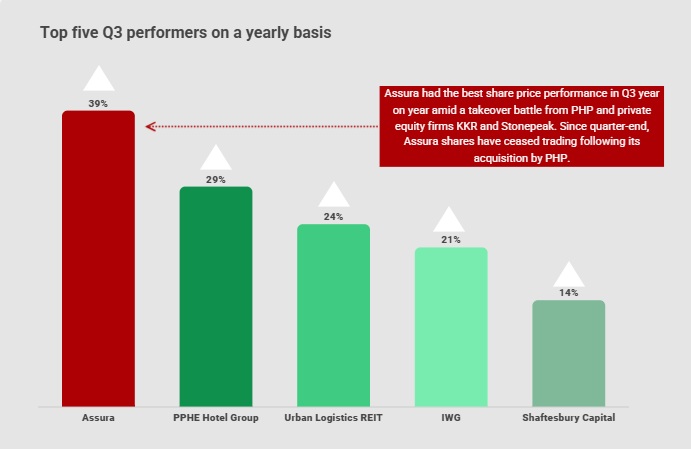

As housebuilders sustained the biggest blows, the situation in the commercial property sector was not much more encouraging. Even NHS landlord Assura was flat during the quarter, despite agreeing to form a £6bn healthcare giant with Primary Health Properties (PHP) in August. Since quarter-end, the merger has received the green light from the UK’s Competition and Markets Authority, cementing the £1.79bn deal for PHP to acquire Assura.

Hopes of recovery gathering momentum in the second half of 2025 faded from late spring

Aynsley Lammin, Investec

Storage group Big Yellow and sector stalwart Landsec saw shares fall 6%, while a raft of listed firms from Workspace Group to Savills saw 5% falls.

Indeed, only one real estate stock ended in positive territory, as serviced office group IWG ended the period with its shares up 3%.

Eleanor Frew, equity research analyst at Barclays Investment Bank, observes that UK commercial real estate stocks were weak over the third quarter of 2025 as concerns surrounding the upcoming Budget also left this sector out of favour.

“IWG was one of the better performers, recovering the losses it saw on the day of its half-year results in August, as we think investors continue to see attraction in its capital-light growth model and exposure to the flexible office thematic,” she says.

Check the bottom line

Frew also raised questions over Unite Group, the UK’s largest student accommodation investor. “Unite Group has been a stock high in focus, with weak performance over Q3 2025 followed by a sharp sell-off on the day of its trading update,” she says. “The group missed its occupancy target for the year, and investors are now questioning the future growth and earnings outlook, which may continue to weigh on the shares.”

Not for the first time, Frew raised the age-old issue around real estate’s focus on net asset value, rather than more solid bottom-line figures. Barclays expects investors’ focus on earnings and cashflow to remain front and centre, with those reporting good growth to outperform those reporting challenging conditions. She adds: “Investors are not focusing on reported asset values as these are made up and do not pay dividends to investors.”

Top five Q3 performers on a yearly basis

Infogram

Andrew Saunders, analyst at Shore Capital, puts the year to date into wider perspective and highlights that 2025 has seen three very distinct quarters. He said the first quarter was dominated by US president Donald Trump’s tariffs and global uncertainty about the implications for trade and the knock-on costs.

“For some sectors, like industrial and logistics operators, that was a period of heightened uncertainty,” says Saunders.

“I think we saw the knock-on effects of that as occupiers delayed decisions to commit to new space or sign leases.”

Stock markets responded negatively to the tariff volatility and there was a sell-off in the first quarter of the year; but in the second quarter, it became evident that a lot of countries were still able to do trade deals. Trump also rowed back on some of his earlier headline numbers that he threatened to introduce, which resulted in a strong bounce-back in the second quarter.

Saunders also highlights that significant mergers and acquisitions activity and positive company announcements, such as Supermarket Income REIT’s internalisation and debt refinance, boosted share prices in the second quarter.

However, the third quarter saw a downturn, primarily due to bond market nervousness about the upcoming Budget. Saunders adds: “This uncertainty has led to higher bond yields, affecting property yields and investor sentiment. Consequently, property investors demand higher returns, leading to lower valuations for REITs.

“The discussion highlights the decoupling of trading performance from stock market valuations, with investors favouring bonds over REITs amid economic uncertainties.”

Follow us on Twitter

Follow us on Twitter

Follow us on LinkedIn

Follow us on LinkedIn